If your business operates in regulated or high-risk industries like healthcare, finance, or online gambling, choosing the right helpdesk platform is critical. The stakes are high – compliance failures can lead to fines, lawsuits, or even shutdowns. Here’s how to evaluate helpdesk options effectively:

- Focus on Compliance: Look for certifications like SOC 2, ISO 27001, or HIPAA. Ensure features like encryption, audit trails, and PII redaction are included.

- Prioritize Security: Multi-factor authentication, role-based access controls, and zero data retention policies are must-haves.

- Consider Scalability: Platforms should support custom workflows, integrations, and region-specific hosting to meet data residency laws.

- Leverage AI Safely: Use platforms with secure AI tools for faster ticket resolution without compromising data privacy.

- Evaluate Costs Clearly: Assess total cost of ownership, including licensing, implementation, and compliance add-ons.

Quick Overview

| Key Criteria | What to Look For |

|---|---|

| Compliance | SOC 2, HIPAA, GDPR certifications; audit logs; PII redaction |

| Security | MFA, RBAC, encryption (TLS 1.2+, AES-256), zero data retention policies |

| AI Features | Secure AI copilots, automated QA, real-time risk detection |

| Customizability | Custom fields, workflow automation, integration with CRM and other tools |

| Cost Transparency | Clear pricing for licensing, training, and compliance features |

Choosing the right helpdesk ensures your business stays compliant, secures sensitive data, and delivers efficient support. Use a weighted scorecard to assess vendors and make an informed decision.

Challenges of Supporting Regulated and High-Risk B2B Customers

Complex Regulatory Requirements

Organizations in regulated sectors face strict rules that leave no room for error. For example, healthcare providers must safeguard Protected Health Information (PHI) to comply with HIPAA and HITECH laws. This means vendors must sign a Business Associate Agreement (BAA) before handling patient data. Similarly, finance and fintech companies must adhere to KYC (Know Your Customer), AML (Anti-Money Laundering), and PCI-DSS standards to ensure payment security. A single mistake in managing customer communications could lead to frozen accounts or even shutdowns.

Data sovereignty adds yet another layer of legal complexity. Helpdesk systems must support multi-region deployments or provide private cloud and on-premise options to comply with data residency laws . This directly impacts vendor selection, as traditional public cloud SaaS platforms often fall short of meeting these requirements.

These regulations demand a helpdesk solution that not only ensures compliance but also supports the unique needs of high-risk industries.

High-Stakes Customer Relationships

In B2B sectors, poor customer support doesn’t just hurt your reputation – it could lead to financial penalties, lawsuits, and lost contracts. Support agents are often the first line of defense against social engineering attacks and account takeovers. Without integrated identity verification, both your business and your customers face increased fraud risks.

Industries like CBD and online gambling face even greater scrutiny. Weak support systems can lead to frozen funds and tarnished reputations. A robust helpdesk must include time-stamped audit trails, acting as a "black box" for regulatory investigations or disputes. These trails are crucial for proving compliance and defending against fraud claims.

Managing these high-stakes relationships while controlling operational costs presents a unique challenge for businesses in these sectors.

Cost Efficiency vs. Operational Complexity

Here’s the issue: only 58% of organizations in healthcare, government, and education use AI tools in their support operations, compared to 92% of tech companies. This disparity highlights a major roadblock. As Brad Murdoch, CEO of Deskpro, explains:

"Organizations including banks, healthcare systems, aerospace and defense contractors, and government agencies… have been left behind by the cloud-only approach to AI-powered support tools, prohibiting them from adopting AI without increasing security risks or violating compliance requirements."

Most cloud-based AI tools process data centrally, which conflicts with data sovereignty laws. But skipping AI altogether means missing out on 30-50% faster ticket resolution times and significant cost savings. This creates a tough balancing act: staying compliant while reaping the efficiency benefits of AI. The answer lies in helpdesk solutions that let you deploy AI securely within your Virtual Private Cloud (VPC) or on-premise systems, ensuring both compliance and efficiency.

| Industry | Key Compliance Requirement | Support System Impact |

|---|---|---|

| Healthcare | HIPAA | Communications must be encrypted and accessible only to authorized users |

| Finance | KYC, AML, PCI-DSS | Mishandling communications can result in fines or account shutdowns |

| High-Risk (CBD, Gambling) | Chargeback Monitoring | Weak tools increase the risk of frozen funds and reputational harm |

| Legal/Education | Data Privacy Laws | Mishandling a single document can cause serious compliance violations |

Grasping these challenges is critical for evaluating helpdesk solutions that align with the needs of regulated industries. A structured scorecard approach tailored to these environments can help businesses make informed decisions.

sbb-itb-e60d259

Using B2B Identity Federation to Prevent Data Leaks and to Boost Operational Efficiency

Helpdesk Scorecard: Evaluation Criteria

Helpdesk Evaluation Scorecard for Regulated B2B Industries

Here’s a detailed breakdown of what to consider when evaluating helpdesk platforms for regulated environments. These criteria address the operational and compliance challenges common in high-risk B2B support settings.

Compliance and Privacy Requirements

Certifications are critical when evaluating vendors. Look for key ones like SOC 2 Type II, ISO 27001, ISO 27018, ISO 27701, and ISO 42001. Each serves a specific purpose:

- SOC 2 Type II: Verifies that security controls are consistently effective over time.

- ISO 27001: Focuses on information security management.

- ISO 27018 & ISO 27701: Address cloud privacy and privacy information management.

- ISO 42001: Demonstrates trustworthy practices for AI-driven platforms.

For industries with unique requirements, such as government contractors, FedRAMP authorization is essential. Without these certifications, businesses risk penalties and audit failures.

Advanced data integrity features are another must. Enterprise-grade solutions should include a dedicated privacy layer to protect personally identifiable information (PII). Features like automatic PII redaction can mask sensitive details, such as credit card numbers, in ticket logs and comments. Encryption protocols should meet modern standards, using TLS 1.2+ for data in transit and AES-256 for data at rest.

Additionally, platforms should support region-specific hosting to comply with local data sovereignty laws. Many cloud-only platforms fall short here, forcing businesses into predefined data center locations.

"Without regulatory compliance software, it can be remarkably difficult to interpret and operationalize legal requirements. Parsing through ‘legalese’ to understand what your organization actually needs to implement to comply with laws and regulations is time-consuming and can lead to unnoticed risk."

- Tim Blair, Sr. Manager, GTM GRC SMEs, Vanta

Finally, evaluate how vendors maintain ongoing security protocols to address emerging risks.

Security and Risk Mitigation

Security goes beyond certifications – it’s about daily enforcement of robust protocols. Key features to look for include:

- Role-Based Access Control (RBAC), Multi-Factor Authentication (MFA), and Single Sign-On (SSO) for restricting access.

- IP restrictions to limit access to approved networks.

- Detailed audit logs to track all administrative and agent actions, which are critical for compliance and resolving disputes.

For AI-driven platforms, check the vendor’s data handling policies. Some offer "zero data retention" models, where customer data is processed in memory but not stored or used to train external models. This aligns with privacy regulations like GDPR and CCPA while leveraging AI capabilities.

Annual third-party penetration testing by certified bodies, such as CREST, is another essential safeguard. With digital fraud increasing by 15% in 2024, leading to $48 billion in losses, a strong security posture can significantly reduce exposure to threats.

Once compliance and security are confirmed, consider how adaptable the platform is to your operational needs.

Scalability and Customization

Regulated industries often require tailored solutions. Your helpdesk platform should adapt to your workflows, not the other way around. Look for features like:

- Custom fields, dynamic SLAs, and workflow automation to handle complex cases.

- Integration capabilities with tools like ERP systems or identity verification solutions for seamless operations.

- Custom data tables to store critical context, such as training records or compliance statuses, directly within the platform.

For global operations, multi-region deployment options are a must. Public cloud SaaS solutions may not meet data residency requirements, so private cloud or on-premise options can offer more control. Scalability also means managing growth without skyrocketing costs. Platforms with usage-based pricing are often more equitable than rigid per-seat models.

AI-Native Features for Efficiency

AI has grown from being a simple drafting tool to an operator capable of executing complex workflows. In regulated environments, AI can now:

- Automate tasks like billing updates, policy-driven refunds, and CRM logging.

- Provide agent copilots that offer real-time summaries, suggested replies, and next-step recommendations to reduce agent workload.

- Enable automated quality assurance (Auto QA), delivering 100% conversation coverage by scoring tickets for tone, empathy, and compliance.

Advanced AI features like Retrieval-Augmented Generation (RAG) ensure responses are grounded in verified, up-to-date data, avoiding fabricated outputs that could introduce compliance risks. Platforms with real-time risk detection can flag suspicious activities, such as account takeover attempts or heightened customer frustration, for immediate escalation.

Privacy remains a priority. Verify the vendor’s AI training policies and look for platforms that offer isolated training or allow you to opt out of global model training. Some even implement zero-retention AI policies, processing data in memory without storing it permanently.

Cost Structure and Total Cost of Ownership

Pricing can vary widely, and the advertised per-seat cost often hides the true Total Cost of Ownership (TCO). TCO includes:

- Licensing

- Implementation

- Integrations

- Training

- Maintenance

- Additional compliance features

For example, a platform advertised at $19 per agent per month might balloon to over $115 per agent when compliance and AI features are added. Switching costs can also be significant if the platform doesn’t scale to meet global data residency or integration needs.

Compliance software typically costs between $10,000 and $80,000 annually, with many teams dedicating 6–10% of their IT security budget to compliance. Outcome-based pricing models, such as per resolution or per minute of usage, are gaining traction but require careful forecasting to avoid budget surprises.

Automating compliance processes can boost efficiency in areas like policy writing and security reviews by over 60%. Platforms with built-in AI features, like automatic PII redaction and audit log generation, can eliminate the need for separate compliance tools, reducing TCO.

| Cost Component | Questions to Ask | Impact on TCO |

|---|---|---|

| Licensing and Add-Ons | What features are included in the base price? | Hidden costs can escalate quickly. |

| Implementation and Training | How long does setup take? Are training resources provided? | Longer timelines increase costs. |

| Scalability and Growth | Does the pricing model support team expansion? | Rigid models can penalize growth. |

Using the Scorecard to Evaluate Helpdesk Options

Creating a Weighted Scorecard Table

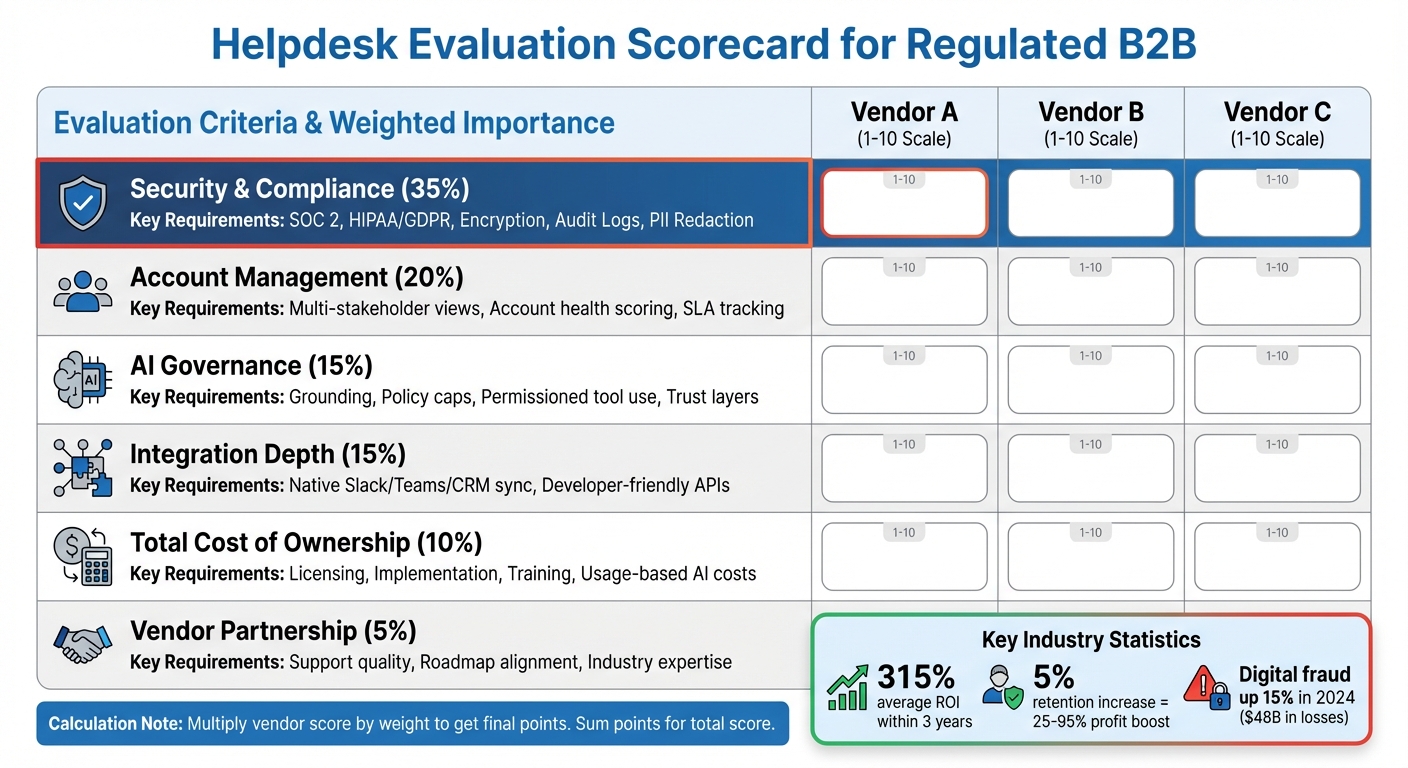

When evaluating helpdesk options, it’s essential to prioritize your organization’s specific needs. Start by assigning weights to each evaluation criterion based on what matters most to your business. For example, in regulated B2B environments, security and compliance should carry significant weight – around 30% to 40%. In contrast, general B2B evaluations might only assign about 5% to these factors. Other key areas like account management could take up 20% to 25%, while AI governance, integration depth, and total cost of ownership might each account for 10% to 15%.

Here’s a sample weighted scorecard tailored for regulated B2B support:

| Evaluation Criteria | Weight | Key Requirements | Vendor A Score (1-10) | Vendor B Score (1-10) | Vendor C Score (1-10) |

|---|---|---|---|---|---|

| Security & Compliance | 35% | SOC 2, HIPAA/GDPR, Encryption, Audit Logs, PII Redaction | |||

| Account Management | 20% | Multi-stakeholder views, Account health scoring, SLA tracking | |||

| AI Governance | 15% | Grounding, Policy caps, Permissioned tool use, Trust layers | |||

| Integration Depth | 15% | Native Slack/Teams/CRM sync, Developer-friendly APIs | |||

| Total Cost of Ownership | 10% | Licensing, Implementation, Training, Usage-based AI costs | |||

| Vendor Partnership | 5% | Support quality, Roadmap alignment, Industry expertise |

To calculate scores, multiply each vendor’s rating by the weight assigned to that criterion. For instance, if a vendor scores 9/10 in Security & Compliance (weighted at 35%), they earn 3.15 points. This method ensures your final decision reflects the priorities critical to high-risk B2B environments.

Conducting Vendor Assessments

Once your scorecard is ready, the next step is to put potential vendors to the test. Rather than relying on generic demos, evaluate 3–5 platforms in real-world scenarios. For example, simulate situations like SLA breaches, critical escalations, or compliance audits that demand detailed activity logs.

During a 4–6 week trial period, involve teams from Support, Customer Success, Engineering, and Security to assess factors like integration complexity, encryption performance, and account visibility. Before starting, ask vendors pointed questions such as:

"Can your platform demonstrate complete audit logs and encryption verification during failure scenarios?"

"If something goes wrong, can this platform prove we did everything right? If the answer’s no, it’s time to choose better." – JivoChat

If a vendor cannot provide robust audit logs or encryption verification, they should be eliminated immediately.

Additionally, consider the total cost of ownership (TCO), which includes not just licensing fees but also implementation, training, and migration expenses. A platform that advertises a $32 per agent monthly fee might actually cost $115 per agent when you factor in compliance features, setup support, and training hours.

Comparing Results and Making a Decision

After gathering assessment data, use your scorecard to compare vendors and guide your decision. Any platform with security or compliance failures should be disqualified outright. In regulated industries, your helpdesk platform must safeguard your business, especially with digital fraud projected to rise by 15% in 2024, costing nearly $48 billion. A single security gap could have devastating consequences.

For vendors that meet compliance standards, compare their weighted scores alongside qualitative factors. For instance, a platform scoring 8.2 overall but excelling in account management might be a better choice than one with a slightly higher score but weaker customer support or implementation assistance. If multiple reviewers are involved, hold calibration sessions to align scoring and minimize bias.

Ultimately, the platform you choose should meet the compliance and operational demands outlined earlier, ensuring it supports your business without compromise.

Common Pitfalls and Best Practices

After evaluating vendors based on key criteria, it’s crucial to stay vigilant about potential missteps that could derail even the most thorough selection process.

Overlooking Compliance and Security Gaps

Before committing to a helpdesk platform, take a hard look at its audit logs and encryption standards. Many consumer-grade tools fall short, lacking time-stamped audit trails that are essential for compliance during audits or disputes. With digital fraud on the rise, your support platform should act as a strong defense against these risks.

An independent audit of each vendor is a smart move. Check if the platform can provide clear, time-stamped compliance evidence when incidents occur. Ensure it supports robust encryption – TLS for data in transit and AES for data at rest – and includes granular, role-based access controls to safeguard sensitive information. Also, don’t just take a vendor’s word for it; certifications like SOC 2, ISO 27001, or HIPAA might only apply to specific products or add-ons, not the entire suite.

Underestimating Integration Complexity

A platform might shine in demos, but if it doesn’t integrate seamlessly with your CRM, payment systems, or risk management tools, it can lead to major headaches. Disconnected tools create data silos, force agents to juggle multiple applications, and increase the chances of errors or compliance issues.

Look for helpdesk platforms with native integrations or strong API ecosystems that allow agents to access a full customer view without hopping between tools. Use the trial period to test these integrations under real-world conditions. For instance, HeliosX transitioned to a platform with better integration capabilities, cutting staffing costs by 50% and boosting customer satisfaction scores by 7%. Similarly, Missouri Star Quilt Company improved its call answer rate by 30% after moving away from a platform that caused dropped calls and poor visibility. Tackling integration challenges upfront ensures smoother operations and better alignment across teams.

Ensuring Stakeholder Alignment

Getting all stakeholders on the same page early on can save you from expensive misalignments down the road. Over half of organizations report feeling overwhelmed by tracking regulatory changes before audits. Without input from teams like Legal, Product, Engineering, and Customer Success, you risk choosing a platform that works for today but can’t adapt to future regulatory or business needs.

Hold cross-functional workshops during the evaluation phase to map out both current and future compliance requirements. Incorporate these insights into your scorecard to ensure the platform you choose is ready to scale with your organization. As Tim Blair, Sr. Manager, GTM GRC SMEs at Vanta, explains:

"Without regulatory compliance software, it can be remarkably difficult to interpret and operationalize legal requirements. Parsing through ‘legalese’ to understand what your organization actually needs to implement… is time-consuming and can lead to unnoticed risk."

Involve these stakeholders during the 4–6 week trial period and hold calibration sessions to align scoring criteria and reduce bias. This upfront effort ensures that your chosen platform serves the entire organization – not just the support team – and avoids costly delays during implementation.

Conclusion

Selecting a helpdesk for regulated or high-risk B2B environments goes beyond ticking off features – it’s about protecting your business while delivering top-tier support. In these scenarios, where compliance failures can lead to frozen assets or legal action, the stakes are incredibly high.

A structured scorecard is a game-changer in simplifying this critical decision. By assigning appropriate weight to non-negotiable factors – like strong security certifications and detailed audit functionalities – you ensure that essential compliance needs are prioritized. This method also fosters alignment among teams like Support, Legal, Engineering, and Customer Success, reducing the risk of costly misunderstandings later. A well-thought-out evaluation process not only simplifies decision-making but also supports measurable business growth.

The numbers speak for themselves. Companies leveraging B2B support platforms report an average 315% ROI within three years, with payback periods of less than six months. Additionally, improving customer retention by just 5% can increase profits by 25% to 95% – a critical edge when managing high-value, long-term B2B partnerships.

Ultimately, an AI-powered helpdesk that meets rigorous compliance standards is indispensable for thriving in high-risk B2B settings. Ensure your platform can confidently answer this pivotal question:

"If something goes wrong, can this platform prove we did everything right? If not, it’s time to find one that can."

FAQs

What certifications should a helpdesk have for regulated industries?

When selecting a helpdesk for regulated industries, it’s crucial to prioritize platforms that meet important certifications to safeguard security, privacy, and regulatory compliance. For healthcare organizations, HIPAA compliance is a must, which includes features like Business Associate Agreements (BAAs). In addition, certifications like SOC 2 and ISO 27001 are vital for ensuring robust data security and privacy standards across various sectors.

These certifications signal that the platform is prepared to manage sensitive information and adhere to stringent regulatory demands, making them essential for high-stakes B2B environments.

How can businesses safely use AI tools in high-risk B2B customer support?

To use AI tools safely in high-risk B2B customer support, businesses need to focus on security, compliance, and context-aware automation. For industries like healthcare or finance, where regulations are strict, AI systems must include features like encryption, access controls, and audit trails to meet standards such as HIPAA or PCI-DSS.

AI can simplify operations by automating repetitive tasks, like filling out compliance questionnaires or drafting policy documents. This not only reduces manual errors but also ensures consistency. Pairing AI with tools like real-time risk monitoring and automated ticket routing can further help detect and prevent fraud or regulatory violations, keeping everything aligned with industry requirements.

To minimize risks, companies should adopt strong security practices, such as conducting regular audits, handling data securely, and performing compliance checks. By prioritizing security, businesses can use AI effectively while maintaining trust and staying protected in high-stakes scenarios.

What should you consider when calculating the total cost of ownership for a helpdesk platform?

When evaluating the total cost of ownership (TCO) for a helpdesk platform, it’s essential to go beyond just the initial price tag. Start with the subscription or licensing fees, which typically vary based on the number of users. Then factor in implementation costs, such as setup, customization, and integration with your existing systems. These expenses can add up quickly, particularly in regulated or high-risk industries.

You’ll also need to account for operational costs, including training, ongoing maintenance, and customer support services. These play a big role in ensuring long-term efficiency and encouraging user adoption. If the platform lacks proper compliance or security features, you might end up spending extra on third-party tools to meet industry requirements.

Lastly, think about the platform’s scalability and flexibility – can it adapt to future growth or changes in regulations? This can have a major impact on costs over time. Opting for a solution with clear, upfront pricing and minimal hidden fees is key to staying on budget.

Related Blog Posts

- Which helpdesk tools are built outside the United States (UK/EU/Canada/Australia)?

- How do you evaluate “foreign access risk” when choosing a US vs non-US helpdesk?

- Which helpdesks offer Canadian hosting – and what questions should you ask vendors?

- How do you run a helpdesk RFP for Canadian organizations (scorecard + requirements)?