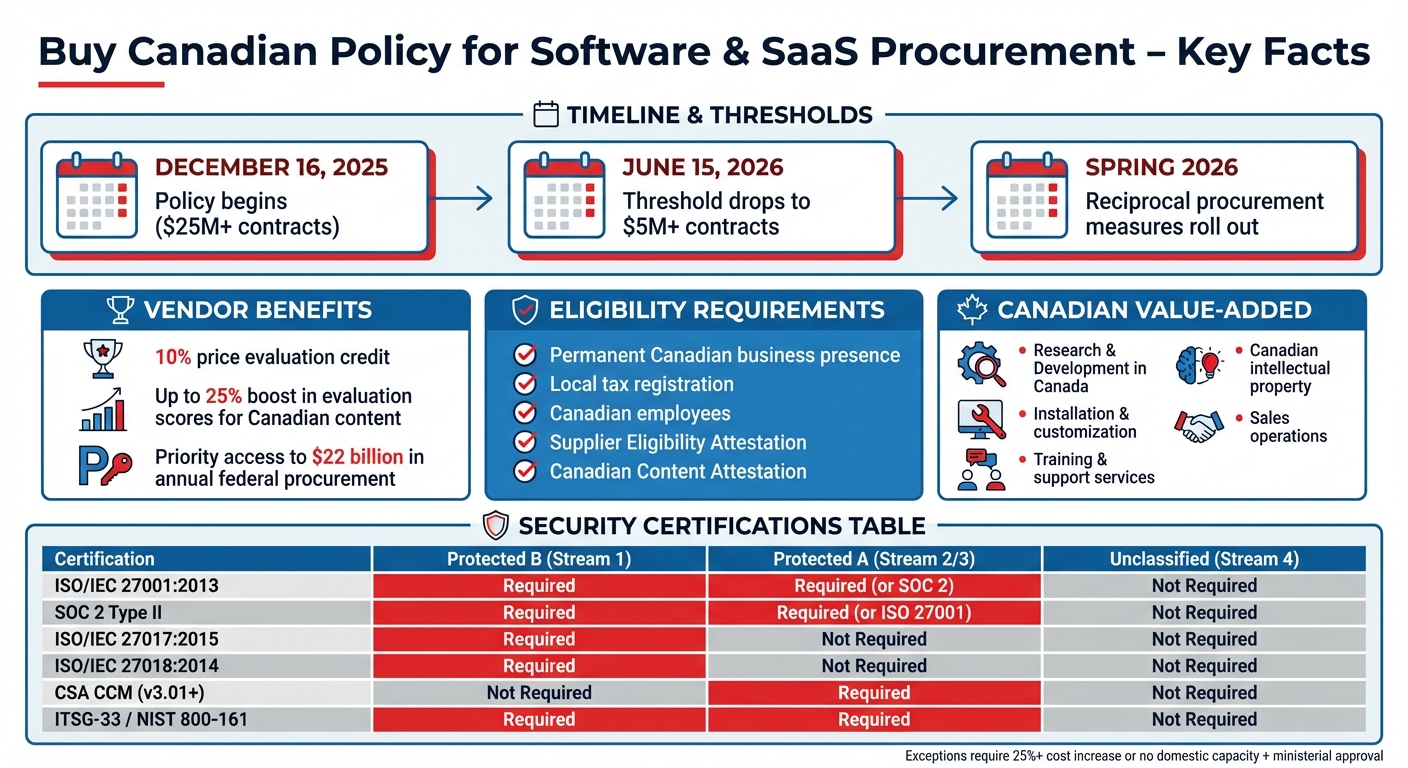

The Canadian government’s new “Buy Canadian” policy, effective December 16, 2025, prioritizes domestic suppliers for federal contracts, especially in software and SaaS procurement. Here’s what you need to know:

- Key Benefits for Canadian Vendors: A 10% price advantage and up to 25% of evaluation scores tied to Canadian value-added content like R&D, support, and training.

- Mandatory Compliance: Vendors must meet data residency, security, and Canadian ownership requirements to qualify.

- Threshold Changes: Contracts worth $25M+ are subject to these rules now, but the threshold drops to $5M on June 15, 2026.

- Focus on Digital Sovereignty: Solutions must use Canadian-managed infrastructure and comply with strict data security protocols.

For SaaS vendors, this policy reshapes competition by rewarding local contributions, while buyers must carefully evaluate providers to ensure compliance without sacrificing efficiency.

Buy Canadian Policy: Key Requirements and Benefits for SaaS Vendors

Minister on new ‘Buy Canadian’ policy: ‘It will help bolster our supply chains and help our economy’

sbb-itb-e60d259

What the ‘Buy Canadian’ Policy Means

The recent federal mandate introduces the Buy Canadian Procurement Policy Framework, a requirement that officially begins on December 16, 2025. This policy shifts from a flexible approach to a firm mandate, prioritizing Canadian suppliers, materials, and content. The goal? To make the government a key supporter of domestic industries, strengthening Canada’s industrial base and reducing reliance on foreign suppliers.

The policy focuses on Strategic Procurement Sectors, with Information and Communications Technology (ICT) playing a central role. This includes choosing the right customer support software, SaaS platforms, and cloud services. To qualify under the framework, vendors must meet specific criteria: they need to maintain a permanent Canadian business, pay taxes locally, employ Canadian workers, and ensure subcontracting does not dilute Canadian value.

Approved vendors enjoy significant benefits, including a 10% price reduction and up to a 25% increase in evaluation scores for contributions made within Canada – such as research and development, installation, training, and support.

Main Goals of the Policy

At its core, the Buy Canadian policy aims to strengthen Canada’s economic stability and reduce dependency on a single trade partner. Considering the federal government spends around $22 billion annually on private sector purchases, this policy is a strategic move to transform industries and promote economic growth across regions.

The Buy Canadian Procurement Policy Framework sums it up well:

"The purpose of the Framework is to provide an overarching foundation for Buy Canadian procurement policies to strengthen Canada’s economic resilience and industrial capacity, and support domestic businesses and workers by prioritizing Canadian suppliers, materials and content in federal procurements."

Another key focus is digital and data sovereignty. The government prioritizes Canadian-sourced digital solutions and infrastructure managed under domestic governance. This not only enhances national security but also reduces risks tied to global supply chain disruptions. For B2B customer support leaders, this means adopting AI-native systems that align with compliance requirements while maintaining efficiency.

Additionally, the policy introduces reciprocal procurement measures, set to roll out by Spring 2026. These measures restrict access to federal contracts for suppliers from countries that don’t offer Canadian firms equivalent market access.

How It Applies to SaaS and Software Vendors

For SaaS and software companies, the policy brings both challenges and opportunities. Starting June 15, 2026, the threshold for contracts subject to these rules will drop to $5 million or more, broadening the range of software procurements covered.

"Canadian Value-Added" for software vendors includes costs tied to activities like research and development, sales, customization, installation, support, and training performed within Canada. To take advantage of the policy’s benefits, vendors must submit two key attestations when bidding:

- Supplier Eligibility Attestation: Confirms the vendor qualifies as a Canadian supplier.

- Canadian Content Attestation: Details the Canadian value-added elements of the bid.

Without these documents, vendors cannot access the 10% price advantage or the 25% evaluation score boost for Canadian content.

Exceptions to the policy are rare and tightly controlled. Ministers can approve them only if the policy would raise costs by 25% or more above market rates or if no domestic capacity exists to meet the need. Such approvals require ministerial-level sign-off, reinforcing the policy’s strict implementation.

Next, we’ll explore compliance requirements in greater detail.

Compliance Requirements for Software and SaaS Vendors

SaaS vendors aiming for federal contracts in Canada must meet specific thresholds, security protocols, and ownership conditions. These rules are part of the government’s strategy to strengthen digital sovereignty and bolster economic stability.

Procurement Thresholds and Vendor Eligibility

Starting December 16, 2025, any procurement valued at $25 million or more will require vendors to hold Canadian supplier status. This threshold lowers to $5 million on June 15, 2026. For contracts under $5 million, while the policy isn’t mandatory, departments are encouraged to prioritize Canadian suppliers whenever possible.

To qualify as a Canadian supplier, vendors must:

- Maintain a permanent presence in Canada.

- Register for local taxes.

- Employ Canadian staff.

Additionally, vendors need to submit two key documents:

- Supplier Eligibility Attestation: Confirms the vendor’s Canadian supplier status.

- Canadian Content Attestation: Details the Canadian Value-Added components, expressed in Canadian dollars.

Without these documents, vendors lose access to benefits like the 10% price evaluation credit or the 25% boost in evaluation scores tied to Canadian content. These benchmarks are critical not only for compliance but also for operational success when competing for contracts.

Once eligibility is established, vendors must meet stringent data and security requirements.

Data Residency and Security Requirements

A key focus of the policy is ensuring that digital solutions and infrastructure are sourced and managed within Canada. For SaaS vendors, this means undergoing mandatory security assessments through the Canadian Centre for Cyber Security (CCCS), addressing both Information Technology Security (ITS) and Supply Chain Integrity (SCI).

Security requirements vary based on the sensitivity of data handled. Vendors must secure clearances through the Contract Security Program (CSP), which includes:

- Designated Organization Screening (DOS).

- Document Safeguarding Capability (DSC).

- Personnel security screenings for all users with privileged system access.

The following table outlines specific certification requirements based on data sensitivity:

| Requirement | Stream 1 (Protected B) | Stream 2/3 (Protected A) | Stream 4 (Unclassified) |

|---|---|---|---|

| ISO/IEC 27001:2013 | Mandatory | Mandatory (or SOC 2) | N/A |

| SOC 2 Type II | Mandatory | Mandatory (or ISO 27001) | N/A |

| ISO/IEC 27017:2015 | Mandatory | N/A | N/A |

| ISO/IEC 27018:2014 | Mandatory | N/A | N/A |

| CSA CCM (v3.01+) | N/A | Mandatory | N/A |

| ITSG-33 / NIST 800-161 | Mandatory | Mandatory | N/A |

If a vendor lacks CSP clearances, securing sponsorship is urgent. The CCCS typically conducts ITS and SCI assessments in six-month waves, so vendors should monitor CanadaBuys for updates.

Beyond security compliance, Canadian value-added contributions play a significant role in evaluations.

Ownership Rights

Federal contract evaluations place emphasis on Canadian intellectual property (IP) and research and development (R&D). Vendors must provide detailed cost breakdowns in Canadian dollars, as these factors influence 25% of the evaluation score. For software and SaaS, Canadian Value-Added includes expenses related to:

- R&D conducted in Canada.

- Customization and modifications.

- Installation, support, and training services.

These ownership and value-added elements underline the importance of aligning with Canada’s broader economic and digital goals.

How to Evaluate Canadian SaaS Providers for B2B Support

When it comes to B2B support operations, selecting the right Canadian SaaS provider is a balancing act. You need to align with regulatory requirements while ensuring operational efficiency. A misstep here could mean getting stuck with costly, inefficient systems that slow your team down. On the flip side, the right choice can streamline operations and improve customer outcomes.

What to Look for When Evaluating Vendors

First, confirm the vendor’s Canadian Supplier Status. This is essential for ensuring compliance and eligibility for evaluation credits. Check their attestations to verify this status.

Another key factor is Canadian Value-Added contributions. Ask for a detailed breakdown in Canadian dollars, covering R&D, support, and intellectual property. Vendors with higher domestic content gain an edge, as this criterion accounts for 25% of the evaluation score.

Data residency and security certifications are non-negotiable, especially for sensitive operations. Confirm that all computing facilities are located in Canada, and ensure certifications like ISO/IEC 27001 and SOC 2 are up-to-date. If the platform uses AI-driven automation, check whether the vendor has completed the Algorithmic Impact Assessment (AIA).

For platforms using AI, assess integration capabilities and operational efficiency. Look for features that automate workflows – like case prioritization, auto-tagging, and predictive CSAT scoring – without requiring heavy IT involvement. Also, confirm they use local CAD accounts and domestic payment methods (such as EFT or Interac e-Transfer) to cut down on foreign exchange fees, which can save 40–60%.

Service Level Agreements (SLAs) are another critical aspect. Look for uptime guarantees of at least 99.9%, clear response time commitments, and protocols for handling outages. Additionally, ensure customer support is provided by natural persons based in Canada during local business hours.

A Framework for Comparing Vendors

To make an objective decision, use a weighted framework that prioritizes the most important criteria. Supplier-related factors often drive over half of procurement performance.

- Canadian Value-Added: Allocate 25% of your score to this category. Evaluate the percentage of R&D, IP, and support performed domestically. Vendors should provide a formal Supplier Eligibility Attestation to confirm Canadian operations.

- Security and Data Sovereignty: Assign 25–30% to this area. Verify certifications like ISO/IEC 27001 and ensure the vendor meets Protected B requirements. They should also maintain exclusive control of encryption keys for cloud-hosted data.

- Operational Factors: The remaining score should cover AI capabilities, integration with existing tools, cost efficiency, and support accessibility. For AI-native platforms, ensure automation features are built-in rather than costly add-ons.

Here’s a sample comparison template to guide your evaluation:

| Evaluation Factor | Weight | Vendor A | Vendor B | Vendor C |

|---|---|---|---|---|

| Canadian Supplier Status | 10% | Yes / No | Yes / No | Yes / No |

| Canadian Value-Added (% of R&D, IP, support in Canada) | 25% | 0–100% | 0–100% | 0–100% |

| Data Residency (servers in Canada for Protected B/C) | 15% | Yes / No | Yes / No | Yes / No |

| Security Certifications (ISO 27001, SOC 2, etc.) | 15% | Pass / Fail | Pass / Fail | Pass / Fail |

| AI Capabilities (natively integrated features) | 15% | Score 1–10 | Score 1–10 | Score 1–10 |

| Support Accessibility (Canadian business hours, local staff) | 10% | Yes / No | Yes / No | Yes / No |

| Cost Efficiency (total cost including FX, integrations) | 10% | CAD $ | CAD $ | CAD $ |

Be cautious about subcontracting. If a vendor outsources critical AI development or support services, it could compromise their Canadian Supplier Status. To clarify, ask directly: "Is your customer support provided by natural persons based in Canada?" A straightforward answer will reveal whether support is being outsourced offshore.

"The thing that auditors look for is if you have your processes documented… build a library of all your applications… You want to be able to adequately tell [auditors] with confidence, this is my list of certified applications."

– Jennifer Clark, Global IT Asset Manager, Hyatt Corporation

Finally, prioritize platforms with open APIs and modular architecture to avoid vendor lock-in. As organizations add an average of 7.6 new applications to their environments monthly, representing 33% annual portfolio growth, seamless integration with tools like QuickBooks, Xero, or Salesforce is crucial. A platform that doesn’t require custom development for these integrations will save you both time and resources.

Meeting Compliance Requirements Without Sacrificing Efficiency

The "Buy Canadian" Policy doesn’t have to mean bloated budgets or sluggish operations. With the federal government spending approximately $22 billion annually on goods and services from the private sector, there’s a massive opportunity for vendors who build compliance into their core platform design. When features like security certifications, data residency, and automated governance are integrated from the start, meeting regulatory demands becomes seamless – without compromising how efficiently your business runs. Let’s dive into how AI-native tools and modular designs help you balance these requirements effectively.

Using AI to Lower Costs While Meeting Compliance

AI-native platforms are game-changers for handling compliance while cutting costs. By automating resource-heavy workflows, these systems can quietly manage compliance in the background, freeing up your team to focus on delivering better customer outcomes.

Take automated patch management, for example. It quickly addresses security vulnerabilities, ensuring adherence to PIPEDA and Protected B standards. AI-driven monitoring can also detect threats and compliance gaps early, eliminating the need for time-consuming manual audits while meeting the "Safeguards" principle of Canadian data protection laws.

When assessing AI capabilities, be sure automation features – like case prioritization, auto-tagging, and predictive CSAT scoring – are included in the base offering. Some platforms charge extra for these tools, which can drive up costs and complicate compliance tracking for Canadian content.

Centralized monitoring systems simplify compliance documentation by automatically creating audit trails and control-testing evidence. These are exactly what auditors need to validate your processes. And with organizations often underestimating their SaaS app usage by nearly 2X, automated tools that uncover shadow IT and classify data are invaluable. They help maintain compliance across your entire application stack without the need for manual oversight.

Avoiding Vendor Lock-In with Modular Systems

Long-term flexibility is just as important as compliance. Vendor lock-in can stifle your operations, so avoiding proprietary traps is crucial. The "Buy Canadian" framework often requires a clear "exit strategy" to ensure your data can be retrieved if you stop using a SaaS tool. This isn’t just a formality – it’s a safeguard against vendors who use proprietary formats or charge hefty migration fees.

Look for platforms with open APIs and export options in accessible formats. As your tech environment grows, seamless integration with existing enterprise systems becomes critical. If a platform demands custom development for basic integrations, it will likely slow you down and add unnecessary costs.

The Software as a Service Supply Arrangement (SaaSSA) offers a modular solution with tiered streams – Protected A versus Protected B – allowing you to align security compliance levels with specific project needs. This prevents overspending on enterprise-grade security for unclassified work while giving you the flexibility to scale up when requirements evolve.

Lastly, insist on transparent documentation of intellectual property rights, software licenses, and third-party dependencies. Knowing exactly what you’re licensing and how your data and customizations will be handled if you switch providers is critical. Open architecture combined with AI-powered workflows ensures you stay in control of your operations while meeting the governance standards of the "Buy Canadian" policy. With these tools, you can achieve both compliance and the adaptability needed to keep pace with changing demands.

Conclusion

The "Buy Canadian" policy, introduced on December 16, 2025, is reshaping how federal procurement works for software and SaaS vendors. With the procurement threshold set to drop from $25 million to $5 million by spring 2026, understanding these compliance requirements is more important than ever.

You can stay compliant without driving up costs or losing efficiency. By leveraging AI-driven platforms that automate tasks like security monitoring and patch management, it’s possible to meet PIPEDA and Protected B standards while cutting down on manual effort. Look for vendors that have compliance baked into their system design.

As you navigate these changes, evaluate SaaS providers with a focus on practical, measurable criteria. Pay attention to essentials like verified data residency and operational flexibility. The SaaSSA framework offers tiered security options, allowing you to align protections with the specific demands of each project. This approach helps you avoid overspending on enterprise-level security for projects that don’t need it.

FAQs

What is the impact of Canada’s ‘Buy Canadian’ policy on international SaaS vendors?

The ‘Buy Canadian’ policy is designed to prioritize software and SaaS providers based in Canada when it comes to government procurement. Its main goal? To bolster local industries while ensuring compliance with Canadian regulations. However, this approach can make it harder for international vendors to win contracts unless they meet certain criteria.

For SaaS providers outside of Canada, there are a few key obstacles to overcome:

- Data residency requirements: Vendors must often ensure that data is stored within Canada to meet regulatory standards.

- Providing local support: Having a Canadian-based support team can be a deciding factor in securing contracts.

- Regulatory compliance: Aligning with Canadian laws and frameworks is essential for staying competitive.

For those without a Canadian footprint, the challenge lies in adapting their services or forming partnerships with local companies to maintain relevance in the public sector market.

What are the data residency requirements for software and SaaS under the ‘Buy Canadian’ policy?

The ‘Buy Canadian’ policy mandates that all data related to Canadian government operations and services must be stored within Canada. This approach prioritizes national security, privacy, and regulatory compliance, while reinforcing the country’s control over sensitive information and limiting the risk of foreign access.

For organizations taking part in federal procurement, this translates to a clear requirement: they must ensure their data resides on Canadian soil. This often involves partnering with cloud providers or data centers based in Canada, particularly when dealing with critical government data and services.

To meet these expectations, it’s crucial to carefully review your data storage solutions. Doing so not only ensures compliance but also helps maintain seamless operations.

What does it take for SaaS vendors to qualify for Canadian procurement benefits?

To tap into Canadian procurement opportunities, SaaS vendors must meet specific requirements set by Canadian policies. One major criterion is maintaining a permanent place of business in Canada, ensuring vendors are accessible during standard business hours. This establishes a local presence and ensures availability for communication and support.

Another key step involves participating in programs like the Software as a Service Supply Arrangement (SaaSSA). This program includes a multi-step qualification process, requiring vendors to adhere to predefined terms and conditions. It’s a structured way for vendors to demonstrate their readiness to meet government standards.

Starting December 16, 2025, the Buy Canadian policy introduces additional expectations. Vendors will need to prioritize Canadian content, comply with regulations, and ensure data residency within the country. Local support infrastructure will also be a critical factor. These measures align with Canada’s procurement goals, offering vendors access to exclusive benefits while supporting national priorities.

Related Blog Posts

- What are the best non-US helpdesk platforms for Canadian companies in 2026?

- Which helpdesk tools are built outside the United States (UK/EU/Canada/Australia)?

- What should Canadian teams check before switching to a non-US SaaS helpdesk?

- How do Canadian data residency requirements affect helpdesk selection?